Chain Abstraction: 2024 Wrap-up Report

Authored by Koni Stack, Across, Particle Network and Avail

Introduction

The blockchain ecosystem is drowning in its own complexity.

As Web3 has scaled, it has fragmented into a maze of disparate, siloed networks, each with its own liquidity, gas tokens, bridges, and user experience requirements. In this context, developers are forced to build for specific chains’ ecosystems, while users struggle with the costly, time-consuming art of bridging and managing chain-specific balances. This is a fundamental barrier to mainstream adoption.

Chain abstraction is the solution to this systemic problem. By providing a bottom-up infrastructure that eliminates the manual complexities of multi-chain interactions, it promises to transform Web3 from a technically demanding environment to a fluid, user-centric ecosystem. Developers can now focus on creating compelling products, while users interact with dApps as intuitively as they would with any digital service—without needing to understand the machinery running beneath the surface.

This report dives into how projects on multiple layers of the chain abstraction stack are coming together to solve the fragmentation problem in 2024.

Problem

Before diving deeper into chain abstraction, let’s try to better understand the consequences of fragmentation.

As a problem, fragmentation goes far beyond the user experience troubles of users having to bridge—it has manifested through several layers of systemic inefficiencies slowing down Web3’s growth:

Technical inefficiencies: Web3’s L2-centric expansion has created fundamental technological incompatibilities. These manifest as redundant development work, where developers must rebuild identical infrastructure across different chains, draining resources, and stifling innovation.

Incentive inefficiencies: Blockchains are trapped in the self-defeating cycle of ecosystem bootstrapping. Billions of dollars are poured into user acquisition and developer grants, yet these funds primarily serve to fragment existing user bases rather than genuinely expand the Web3 ecosystem through new users.

Ecosystem inefficiencies: The current landscape forces developers into a repetitive pattern of building foundational products—AMM DEXs, lending markets, stablecoins—across multiple chains. This diverts attention from truly innovative solutions that could attract mainstream users, creating a cycle of diminishing returns.

These inefficiencies are critical barriers and, as inefficiencies do, tend to magnify each other.

Solution

Chain Abstraction Adoption

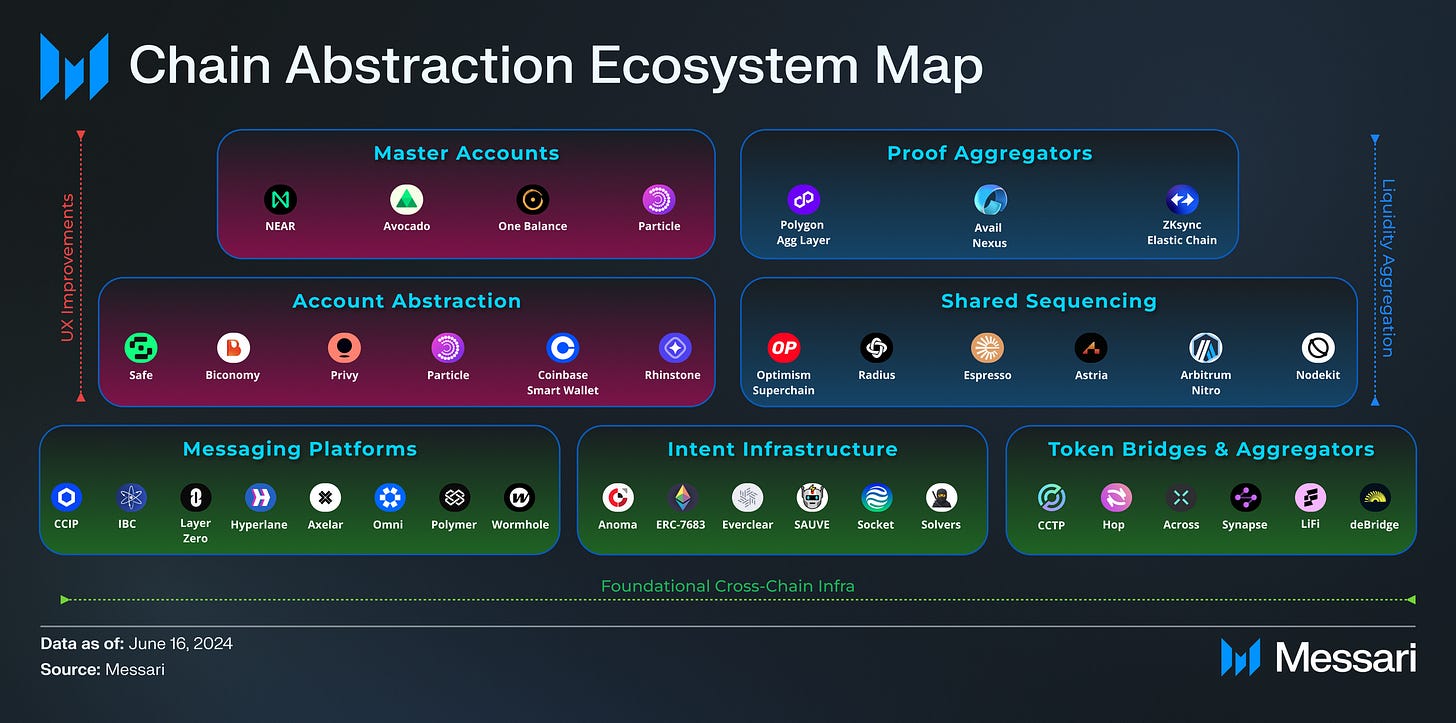

Chain abstraction as a movement has been gaining momentum in 2024, with the number of projects adopting the stack significantly increasing compared to last year. At the time of writing, more than 80 projects were included in the Chain Abstraction Hub. New standards emerged in response to the demands for cross-chain interoperability and intent-based designs, such as ERC-7683 and EIP-7702. In an X post that surpassed 210K views and 1.3K likes, Uniswap announced 35 ERC-7683 adopters that shared one mission of “Unifying Ethereum Together”—and the list is constantly increasing. Safenet, whose mainnet is expected to launch in 2025, plans to support EIP-7702 to accelerate smart accounts after the Pectra Ethereum upgrade.

From early 2024, side events about chain abstraction have been popping up in major Web3 events such as Chain Abstraction Day in ETHDenver and EthCC. During Devcon Bangkok, chain abstraction became a major theme with 20+ sessions, 10+ side events and 50+ live demos. In a panel discussion titled “Unified Ethereum” vs “L2 Ecosystem Competition”: Can we have both?, Ethereum co-founder Vitalik Buterin stressed the importance of a unified UX on Ethereum and endorsed community efforts in collaborating on standards like ERC-7683. Most recently, Messari’s Crypto Theses 2025 listed interoperability and chain abstraction as trends to look forward to in 2025, with chain abstraction “shaping up to be one of the biggest trends to watch in the coming year.”

With such strong foundation, we can safely expect that chain abstraction’s adoption will spread even more widely in 2025.

ERC-7683 and CAKE Framework

Developed by Frontier Research, the CAKE framework has given us a clear blueprint for achieving chain abstraction through its four key layers: Application, Permission, Solver, and Settlement.

However, without a common language for these layers to communicate, Ethereum would become many orders of magnitude more fragmented than it currently is. We need a common standard that allows all these systems to speak the same language.

What is most exciting about ERC-7683 is how it fundamentally transforms cross-chain interactions through a standardized intent architecture. Think of it as an order ticket system—similar to how traditional financial markets standardized order formats through protocols like FIX (Financial Information eXchange). This standardization was crucial for those markets to scale, and the same principle applies to how we move value in crypto today.

The ERC-7683 standard defines a simple but powerful format: origin chain, origin token, origin amount, destination chain, token amount, and a fill instructions field that enables sophisticated cross-chain operations. This standardization means wallets only need one integration to support all cross-chain actions, and solvers can focus on optimizing execution rather than juggling multiple proprietary formats.

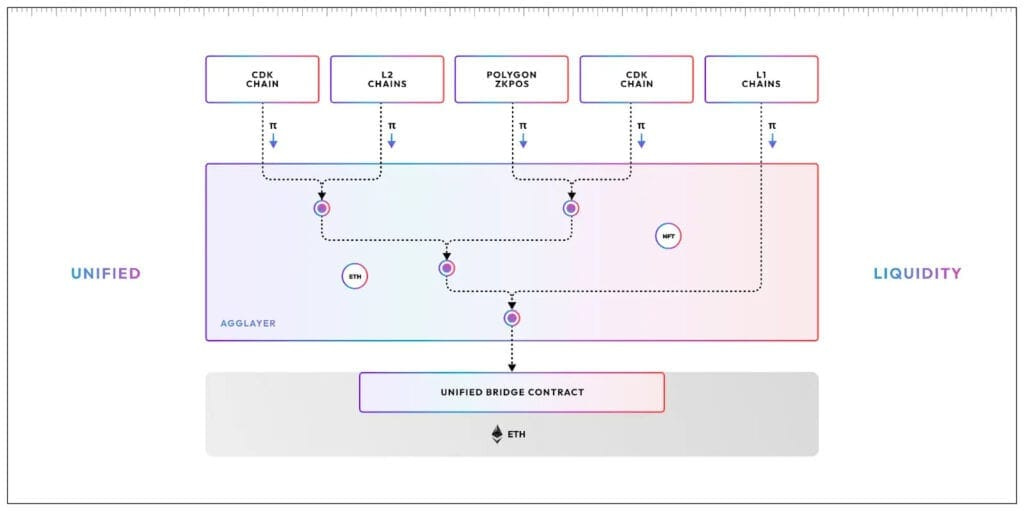

What makes this architecture particularly powerful is how it builds on and enhances other blockchain innovations. When L2s develop better native interoperability (like Optimism's Superchain or Polygon's AggLayer), the intent system becomes more efficient. When new messaging protocols emerge, intent settlement becomes faster and cheaper. The solver network seamlessly adapts to these improvements, creating a virtuous cycle of innovation.

Let’s take a closer look at each layer of the CAKE framework in the following sections.

Settlement Layer

The settlement layer is responsible for verifying computation and finalizing transactions, ensuring they cannot be reversed. L2 rollups that choose to settle transactions on Ethereum use smart contracts on the Ethereum blockchain to do so. As this finalization process can take hours or even days to complete, rollups improve the user experience by providing faster pre-confirmations before finalization. Once an L2 rollup transaction is finalized on Ethereum, assuming immutable contracts, it cannot be reversed.

Preparing transactions for settlement becomes even more complicated when designing for cross-chain transactions and moving beyond solving for just Ethereum L2s. This is because there are many more potential ways in which things could go wrong. For example, a transaction could fail on one chain, or a re-org could happen on another. All of these factors add complexity to the design space.

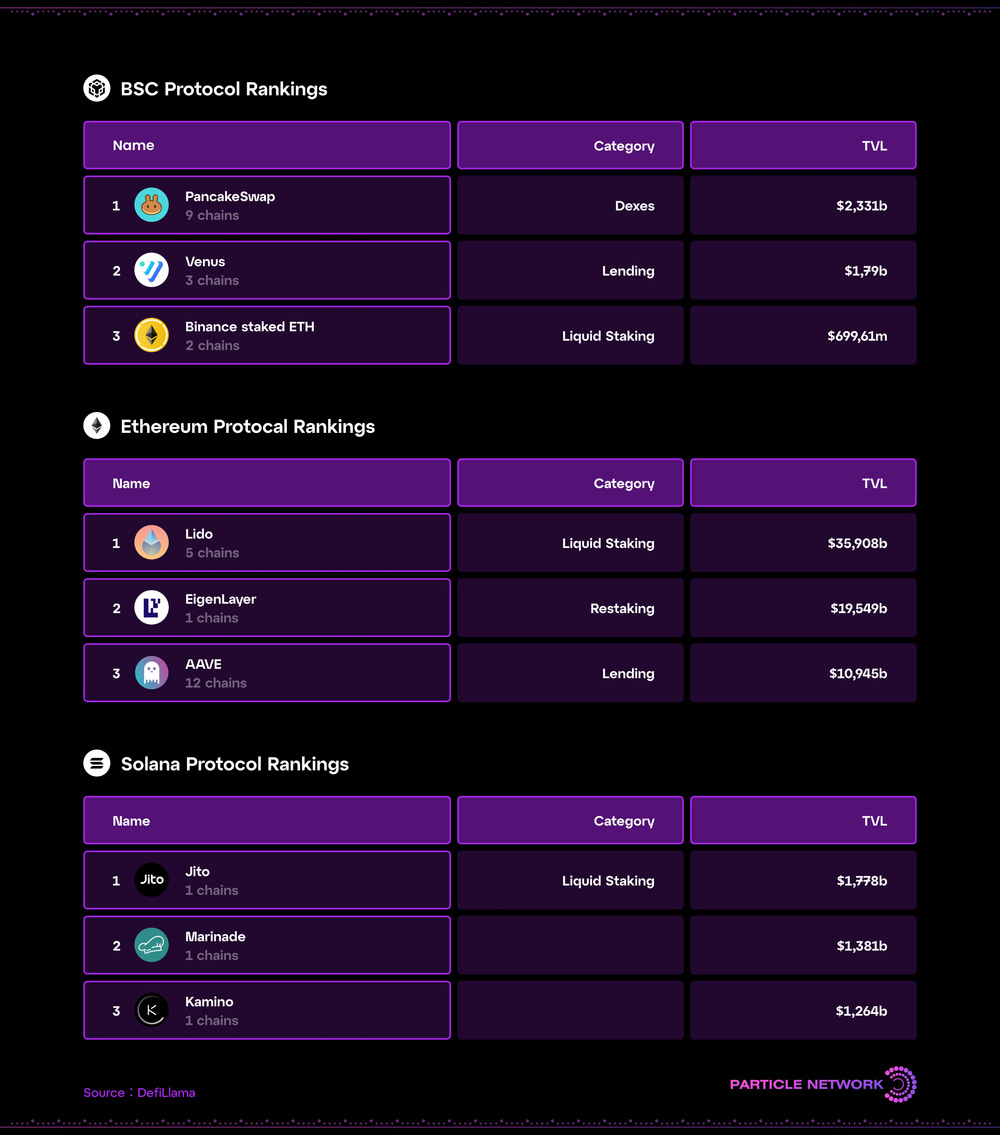

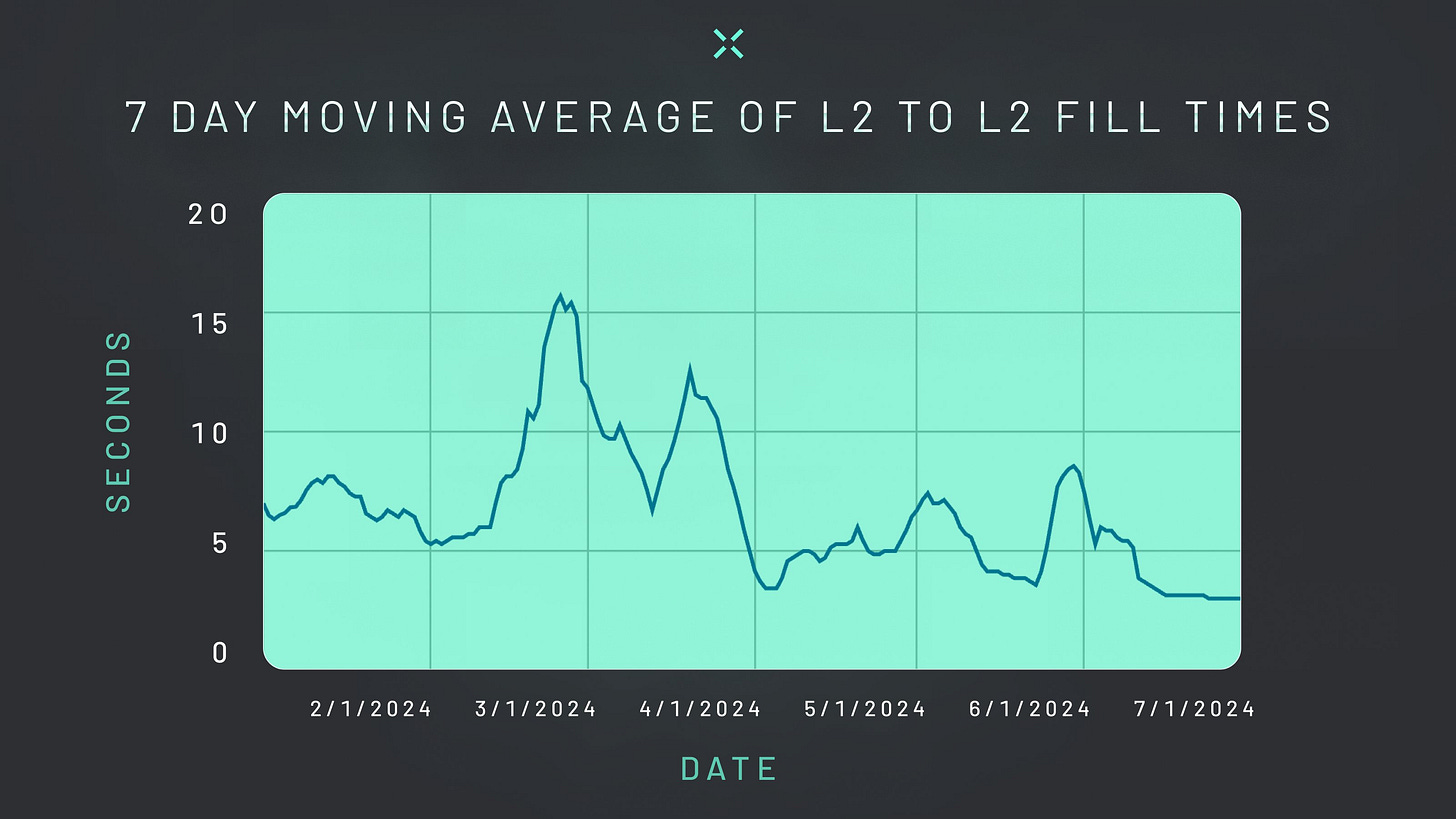

Numerous approaches are being pursued to solve this problem at different levels of the stack. Oracles like LayerZero, Wormhole, ChainLink and Axelar Network are all ‘out-of-protocol’ oracles which help facilitate the passing of messages between different chains. Cosmos IBC, Polygon AggLayer, Optimism Superchain and the ZKsync Elastic Chain are examples of ‘in-protocol’ oracles that enable message passing among chains within the same ecosystem. Shared sequencers are also being pursued as a way of facilitating cross-chain transactions before they are submitted in batches to the underlying chains. In addition to this, there are intent-powered protocols like Across which has improved the UX significantly, enabling end users to receive funds in seconds instead of waiting days for transactions to finalize.

Each team is working towards the same goal, with different trust assumptions and user guarantees. A recent and exciting approach to cross-chain transactions comes from Avail. This will enable not only transactions to happen between different chains, but also users to verify these transactions from their phones without running a full node.

Solver Layer

The solver layer takes the user's intent, identifies how best to execute the transaction(s), and returns a fee and confirmation time. The paths to fulfill an intent can be within the protocol, or leverage third parties, adding security assumptions, depending on how the solver is configured. Solver-based bridging has specifically been a key innovation for chain abstraction due to the efficiency of liquidity fronting over traditional bridging mechanisms.

To fulfill a user’s intent within a public network, some challenges arise, as broadcasting an intent opens up vulnerabilities like front-running. Rather than exploit these vulnerabilities for personal gain, the goal of a solver is to add value to end users. Solvers can attract more order flow and improve their compensation by competing to achieve better prices for end users. This helps align the incentives of the user and the solver.

There are, however, centralization risks to mitigate. The solver layer benefits greatly from informational advantages, expertise within a particular niche, and having access to private order flow. This drives a ‘winner-take-all’ dynamic and can lead to centralization among the solver layer, enabling solvers to extract rents from users or even censor transactions.

A number of prominent projects within the solver layer have emerged to tackle these challenges, including Khalani, Anera, Propeller Heads, Skip Protocol and Squid. So far, the majority of development effort has gone towards solving objective user intents. These intents, such as swap 100 USDT for ETH, have a clear, best answer, making them easier to solve.

The rise in the number of rollups not only adds more fragmentation pressure; it increases the surface area of the types of intents a user may wish to solve. This will increase the scope for solvers over time, with more subjective use cases having less clear answers. For example, selecting the ‘best’ loan may be subject to other factors, such as the user’s risk profile, where the most competitive rate doesn’t necessarily reflect the best option for the user.

Potential solutions to address these dynamic challenges include introducing standards, utilizing solver DAOs, adding geographically localized solver instances, new accountability frameworks and increasing the granularity of control for users or developers looking to fulfill an intent. This remains an active area for further research and experimentation.

Permission Layer

The permission layer is the entry point for a user, where they can express their intent and receive fulfilled cross-chain transactions. This user facing layer handles all the complexities to complete cross-chain transactions behind the scenes, including interacting with the Solver and Settlement layers. The user essentially gives permission to the Permission layer to sign transactions on their behalf.

The current user experience for interacting across multiple chains often requires configuring different networks, signing multiple transactions, and ensuring you have the right tokens on the right networks to pay for gas fees. This is a suboptimal experience, and something the permission layer aims to address.

Demo of Arcana Wallet on Jumper Exchange

Changing how user wallets work goes a long way towards addressing these usability issues. Today, Externally Owned Accounts (EOAs) like MetaMask have the private keys controlled by users and require the user to sign each transaction individually. When transacting across multiple chains, the desired user experience is that a user expresses an intent, signs the transaction only once, and has their intent fulfilled. Smart contract accounts like those based on ERC-4337 introduce arbitrary business logic to a wallet that has the ability to execute a string of transactions on behalf of the user, once it has been authorized to do so. This, used in combination with multi-party computation which ensures private keys are split between the user and an authorized account, can help execute multistep cross-chain transactions without the user giving up possession of their private key.

This is where EIP-7702 comes in—it allows EOAs to transform into smart contract accounts and by doing so enables millions of existing EOAs to enjoy the optimal UX that chain abstraction brings. Adopting EIP-7702 on the wallet level means that applications only needs minimal updates to be compatible. As smart accounts become ubiquitous through the Petra upgrade, we will unlock new possibilities for chain abstraction. Users will be able to execute complex cross-chain actions with their home chain acting as a universal gas tank, all while maintaining the two-second execution speed that users expect.

Teams that are making progress building out the permission layer include Avocado, Pimlico, Near Accounts, Particle Network, Arcana, Safe and SubWallet.

Application Layer

The three aforementioned layers collectively materialize in the application layer, implemented to enable the “chain-abstracted” experience we are shooting for. These are often referred to as “chain-agnostic” applications, in which users can access and transact within them without holding assets natively on the chain in which it is deployed; rather, they are given a unified balance to use. The application is usable by users anywhere, not just on one or a few distinct chains, thus capturing the essence of chain abstraction.

At this point in time, there are not many applications that have achieved this outright, as the former three layers are themselves still materializing in tangible, widely available infrastructure. But, there have been a few:

UniversalX by Particle Network launched just a few weeks ago as the “first chain-agnostic trading platform.” It uses Particle Network’s Universal Accounts, alongside other parts of the stack, to create an experience in which users can buy and sell tokens on any chain with a unified balance. For example, buying WIF on Solana using ETH aggregated from Base, Arbitrum, and Ethereum. This is, by some measure, one of the first production-ready applications to embrace complete chain abstraction, although it is hardly the last.

OneBalance’s account interface has also been live for some time and represents an equally chain-abstracted experience, specifically in the context of managing a OneBalance account (transfers, swaps, etc). This is currently OneBalance’s flagship showcase of their Credible Account infrastructure, representing one of the earliest completely chain-abstracted accounts to be usable on mainnet.

SubWallet introduced 1-click cross-chain swap on their web dashboard, browser extension and mobile app. The app/wallet currently supports 200+ swap pairs from 30+ tokens across 6 networks in Polkadot and Ethereum ecosystems, making it ultimate gateway for Polkadot to branch out. SubWallet’s unified account that aggregates assets from 200+ networks in Polkadot, Ethereum and TON ecosystems is also a significant effort towards chain abstraction.

While it is unclear at this stage how much traction these experiences have had relative to their traditional counterparts, the initial feedback for all the applications mentioned above has been overwhelmingly positive. Users have virtually unanimously expressed the want for the experiences shown in these applications to be standard across the industry.

To make things easier for applications to communicate with all providers in the lower layers, tooling products like Koni Stack are emerging. Koni Stack takes the as-a-service approach and builds SDK for dApps and Telegram mini apps to run on all chains with only one-time deployment. Their PoC dApp is scheduled to launch in Q1 2025—below is a demo of the stack.

Conclusion

Chain abstraction has gone from 0 to 100 this year. As a vertical, we have taken a vague, relatively unknown idea and grown it to be one of the most pressing narratives in the industry. Alongside significant innovations in the aforementioned categories, specifically relating to solver-based bridging and account abstraction, chain abstraction is closer to being the standard user experience than ever.

As we approach 2025, we are on a clear and very fast-moving path towards an era in which nearly every on-chain experience is entirely chain-abstracted. This allows users to have far more Web2-like experiences, applications to focus on deploying where it makes the most sense for them technologically, and the industry to finally experience “true free-market competition” between protocols.

Better infrastructure, better apps, better experiences—chain abstraction is the first domino in a path towards a far more efficient and innovative ecosystem. 2024 was the inception of that: we either simplify or die.

With projects like Particle Network shipping UniversalX, OneBalance powering various projects, SOCKET gaining traction, various adjacent technological changes (as previously covered), and other providers entering the market, we are rapidly approaching the complete materialization of this “chain-abstracted future” we have been discussing all year.